138 Views

Teach Your Children Well - Crosby, Stills and Nash Inspires Me

by

Pat Ruge

(IC: homeowner)

2 Materials

1 Hour

Easy

When I was a small child, I can remember the bank would encourage us to open a Christmas Savings Account where we could put in a minimum of 25 cents a week to save for Christmas. By today's standards, $12 at the end of the year, may not seem like a lot, but in 1952 when I was 10 years old, that was a lot of money. In 2017, that would equate to about $120. A ten year old today, might have a lot of fun with $120, just as I did with the $12 back in 1952.

.

Back then, the bank knew that if we learned to be savers as youngsters, we would most likely be savers as adults. But banks don't do that today. Today, if you open a savings account with less than $5,000 they want to charge you a "service fee" upwards of $25/month.

.

So how do we encourage our young people to save money without it costing them an arm and a leg.

Begin with an empty jar and an idea what they might like to be saving for. Could be a surfboard, could be a new bike, or if you have a tween, could be their first car. Adjust the size of your jar to age appropriate. You don't want them to end up with a few coins at the bottom of an otherwise, very large but nearly empty jar. Make the jar pretty and fun. Bling it up.

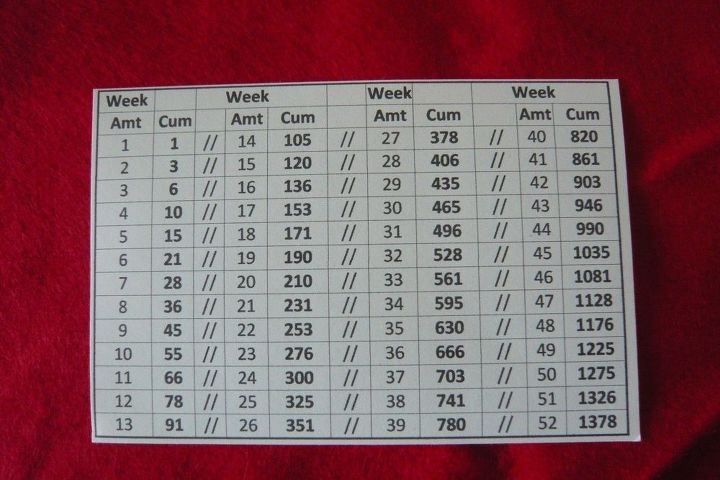

This savings plan starts off small and builds up over the course of 52 weeks. The sample I show here means putting $1 in the first week, $2 the second week, $3 the third week until you get to $52 on week 52. If the plan is followed consistently, week after week, at the end of 52 weeks, there will be $1,378 in the piggy bank.

.

It does start off slow, but as each week passes, more is required and the faster it grows. It also gives them the opportunity to think about "Where am I going to get the $10 in the 10th week, etc.?" They may even enlist you to bounce off ideas for how to EARN that next installment. Kids can get very creative when it comes to money. It's fun to watch that creativity show up.

.

My granddaughter, Sarah, lives in "Horsetown USA" with a horse trail right outside the house. When she was very young, she would go out and sell a handful of grass to the riders who came by on their horses for a quarter. Talk about creativity.

.

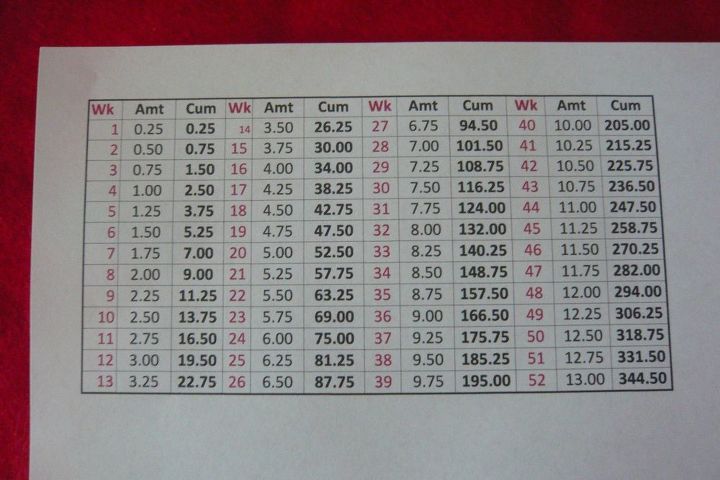

The weekly savings amount can be easily adjusted to age appropriate and/or final goal amount needed. The voice of experience (that would be me) is here to tell you that every child loves to see their money grow - hence the clear glass jar.

.

I have printed this on a FedEx label and cut down to size before adhering it to the jar. ModPodge would work also. I wish I could upload my excel spreadsheet, but I can't. Hopefully you have excel to do that. I have the columns so they automatically calculate the weeks and the cumulative amounts.

As you can see, even starting with 25 cents, it can end up with $344.50. A nice chunk of change and a very valuable lesson learned.

If you use the label, let them highlight each week where they added the amount, so they know where they are in their savings.

.

I encourage a 52 week plan. Primarily because by the end of the 52 weeks, they have learned a lot about money, how to save it, and how to make it. Don't just hand it to them - unless of course, this is your piggy bank.In case you think you are too old for a piggy bank, I use this to help me reserve the amount for my adult son's Christmas present. It's more fun to present it than a check and he knows he has it to look forward to. (PS: I keep the bank). It's become our tradition.

If you use the label, let them highlight each week where they added the amount, so they know where they are in their savings.

.

I encourage a 52 week plan. Primarily because by the end of the 52 weeks, they have learned a lot about money, how to save it, and how to make it. Don't just hand it to them - unless of course, this is your piggy bank.In case you think you are too old for a piggy bank, I use this to help me reserve the amount for my adult son's Christmas present. It's more fun to present it than a check and he knows he has it to look forward to. (PS: I keep the bank). It's become our tradition.

Enjoyed the project?

Suggested materials:

- Glass Jar w/lid

- Label showing weeks and amounts

Published January 8th, 2018 7:24 AM

Comments

Join the conversation

2 of 7 comments

Frequently asked questions

Have a question about this project?